- On The Ground by DealGround

- Posts

- The Changing of the Guard in Fast Food Real Estate

The Changing of the Guard in Fast Food Real Estate

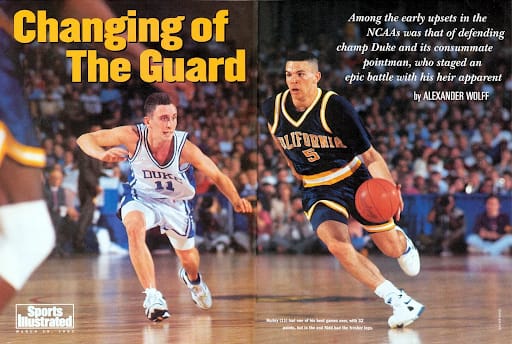

Wolff, Alexander. “Changing of the Guard.” Sports Illustrated 78, no. 12 (March 29, 1993)

Welcome back to On The Ground by DealGround and a big shoutout to the hundreds of new subscribers who signed up this last week. This is your biweekly briefing on what's actually happening in CRE, powered by DealGround's data and deal intelligence.

The Changing of the Guard in Fast Food Real Estate (1 Min Read)

Over the last decade, fast food real estate has seen a seismic shift — and there’s no turning back. Here’s what every investor, broker, and developer needs to know:

The “Big Three” — Raising Cane’s, Chick-fil-A, and In-N-Out — now dominate the market. Their monster sales volumes (some stores doing $10M+) mean they can pay rents that dwarf max rents for the legacy household fast food names.

Legacy brands like McDonald’s, Taco Bell, Wendy’s, and Panda Express?

They’re now B-tier tenants, unable to compete on rent for prime sites. C-tier tenants like KFC, Arby’s, and Burger King (who may not even survive the next 5 years) are left scrambling for relevance - nobody is building for them.

Site selection strategies must change.

Landlords pursue the Big Three first. If they’re not an option, the next call is to car wash operators. After that, we are talking Starbucks, Dutch Bros, or newcomers to drive-thru and pick-up concepts like Chipotle and Shake Shack.

The playbook has changed.

Smaller sites = opportunity. Tenants who can adapt to tighter footprints and lean operations with minimal or zero on-premises dining (à la Starbucks) can still win A+ locations without matching $400K+ rents.

Competition for drive-thru real estate is fiercer than ever.

If your tenant can’t generate >$2M in sales, they’re likely boxed out of top-tier metros.

What You Need To Know

Each new deal done pushes market expectations higher and higher. There is a breaking point. Landlords are seeing Big Three ground lease rents at rates that are 2-3x what the legacy players were paying. This has created a seismic shift in landlord expectations.

Tracking and understanding what is happening in any given market is becoming more and more important by the day. Nobody wants to leave money on the table. Conversely, nobody wants to fumble an opportunity because of unrealistic expectations. Read the full article here.

Get the Edge with DealGround

Stop trying to manage your data in spreadsheets and from memory. DealGround lets you save, organize, and extract insights from every deal you’ve ever touched and the ones you haven’t. Stay on top of the market with the most simple information aggregation tool ever built.

What You Can Do with DealGround

Search lease term and rent history by use type / location / tenant

Uncover off-market opportunities upstream from the competition

Filter for properties with short lease terms / options remaining

Track market rents and model trends in your market

Bottom Line

The Big Three have pulled back the curtain on where the market is and is heading. The cat is out of the bag. Well-positioned fast food operators can pay huge rents because they generate massive sales. The previous incumbents must adapt or die. Some have figured it out, others not so much.

Be Kind and Win.

DealGround

P.S. (For Retail Investors)

Do you know all the rent comps in your market? If your tenant vacated tomorrow, would you know the last 10 deals in your surrounding area? Being armed with this information is a superpower. Click Here, We'll help you get there.